Baby Diaper Market

Baby Diaper Market- Global Industry Size, Share, Trend Analysis, Outlook, Growth, Opportunity and Forecast, 2017-2027, Segmented By Product Type (Cloth Diapers, Disposable Diapers, Training Nappies, Swim Pants, Biodegradable Diapers), By Distribution Channels (Supermarkets/Hypermarkets, Convenience Stores, Retail Stores, Specialty Store, Online Channels), By Region (North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle-East & Africa (MEA)

- Published Date: November 2021

- Report ID: BWC1826

- Available Format: PDF

- Page: 450

Report Overview

UN statistics state there are more than 140 million babies born every year. Due to the high number of babies born worldwide, the global market for baby diapers is growing substantially. To capitalize on this fast-growing market, many brands are entering the baby diaper market and launching various products at competitive prices.

Global Baby Diapers Market- Industry Trends & Forecast Report 2027

The global baby diaper market was worth USD 48.1 billion in 2020 and is further projected to reach USD 76.5 billion by the year 2027, growing at a CAGR of 3.4% in the forecast period. The baby diaper market is experiencing tremendous growth thanks to the growing awareness about the quality of the diapers used and growing expenditure on baby care. Moreover, the growing trend of eco-friendly diapers, which decompose more efficiently and are less harmful to the environment, is anticipated to provide lucrative growth opportunities to the global baby diaper market.

Source: BlueWeave Consulting

Global Baby Diaper Market- Overview

Baby diapers are pads used for absorbing and retaining body fluids. Diapers such as these are worn by toddlers who are not yet toilet trained as they are too young. In order to ensure maximum comfort for the babies and prevent leakage, these diapers are often designed in the form of pants. The majority of baby diapers are made from polypropylene non-woven films. These days, biodegradable materials such as cotton, hemp, bamboo, or microfiber are also used to make diapers.

Global Baby Diapers Market Forecast and Trends

Growth Drivers

Increasing Baby Births

According to an estimate, around 385,000 babies are born each day worldwide. Based on the records of UNICEF, around 67, 385 babies are born in India alone, which is one-sixth of the world’s childbirths. Such a high number of babies being born worldwide is proving to be a boon for the baby diaper market. This is why, countries with high populations and densities such as India, China, South Korea, etc., offer a diverse consumer base to the baby diaper market.

Growing Penetration of Online Channels

The increasing penetration of smartphones and improving internet accessibility are providing lucrative growth opportunities to the baby diaper market worldwide. The market is flooded with consumer goods websites, such as Amazon.com, Walmart, Grofers, Firstcry.com, etc., which offer diapers of different brands at discounted prices, thereby attracting consumers. Various companies are also entering the diaper delivery market to expand their market scope. Uber Eats, for instance, recently introduced a new delivery category, ‘Babies and Kids’, to deliver diapers and thermometers.

Restraints

Side Effects of Using Diapers Regularly

Diapers are a blessing for babies and mothers. Regular diaper use, however, poses a severe threat to a baby's health. In disposable diapers, leak-proof & super absorbent polymers and scented chemicals can lead to chronic diaper rash and severe respiratory problems such as asthma. Babies can also develop allergies from dyes used in colorful diapers. Furthermore, regular use of diapers can also make way for chemicals to enter the baby's system. Such factors may restrict the growth of baby diapers.

Impact of COVID-19 on the Global Baby Diapers Market

The unforeseen situation caused by the COVID-19 pandemic negatively impacted the growth of the baby diapers market. As countries imposed strict lockdown restrictions to curb the virus spread, it led to panic buying of essential commodities, such as baby diapers and toilet papers. Due to a shortage of workers and restrictions on international trade, production and supply chains were cut down. This resulted in huge demand and supply gap, incurring huge losses to the market. Despite this setback, the market is expected to recover in the post-COVID-19 period, as companies are focusing on increasing production to meet market demand.

Global Baby Diapers Market - By Product Type

Based on product types, the baby diapers market is segmented into cloth diapers, disposable diapers, training nappies, swim pants, and biodegradable diapers. The disposable diapers segment accounts for the largest market share because of the high penetration of this type of diapers in convenience and retail stores. However, cloth diapers and biodegradable diapers are estimated to register substantial growth during the forecast period because of the increasing environmental consciousness among consumers and demand for reusable diapers that prove to be budget-friendly.

Global Baby Diapers Market - By Distribution Channel

Based on distribution channels, the global baby diapers market is segmented into supermarkets/hypermarkets, convenience stores, retail stores, specialty stores, and online channels. The convenience stores segment accounts for the largest market share because of its presence in various locations and regions. Convenience stores also offer a wide variety of baby diapers of various brands and they are accessible at any time of the day. However, the online channels are projected to witness the highest CAGR during the forecast period owing to the increasing popularity of consumer good websites such as Amazon.com.

Global Baby Diapers Market - Regional Insights

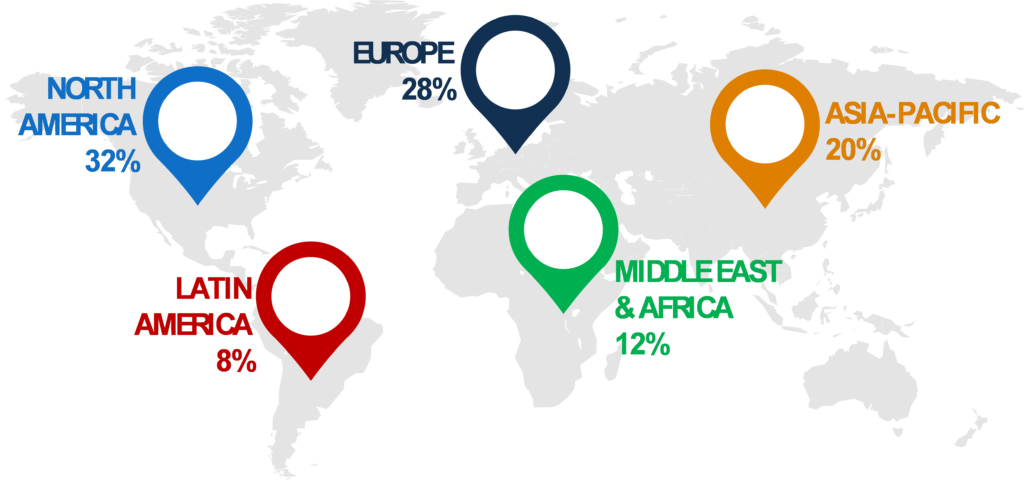

Geographically, the global baby diapers market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle-East & Africa. As a result of high disposable income and high expenditure for quality baby products, North America dominates the baby diapers market. As a result of increasing environmental consciousness, cotton and biodegradable baby diapers are expected to offer lucrative growth opportunities in this region. In contrast, the Asia-Pacific region will likely to experience the highest growth rate during the forecast period.

Global Baby Diapers Market - Competitive Landscape

The leading players in the baby diapers market are Hengan International Group Co. Ltd, Kimberly Clark Corporation, Procter & Gamble Company, Unicharm Corporation, Johnson & Johnson, Kao Corporation, Ontex Group, Hayat Kimya Sanayi AS, Seventh Generation, Domtar Corporation, Drylock Technologies, Cotton Babies Inc., Winc Design Limited, Daio Paper Corporation, Essity Aktiebolag, Bumkins, First Quality Enterprises, Inc., The Honest Company, Inc., The Hain Celestial Group, Inc., and other prominent players.

The market is highly concentrated and is dominated by global giants, such as P&G, Unicharm, and so on. These companies launch a wide range of products for various age groups and requirements. They also significantly invest in R&D activities to improve their absorption technology and gain a competitive edge. Furthermore, the adoption of market strategies like product launches, partnerships, mergers, acquisitions, joint ventures, etc., is also prominent in this market.

Recent Developments

-

In October 2021, Dabur India Ltd., an Indian multinational consumer goods company, announced its plan to enter the baby diapers segment with the launch of ‘Dabur Baby Super Pants’ that offer insta-absorb technology for 50% more absorption compared to other brands.

-

In October 2021, Hayat Group, the Turkish consumer goods manufacturer, announced to be expanding their baby diaper brand called Molfix in the Vietnamese market.

Scope of the Report

|

Attributes |

Details |

|

Years Considered |

Historical data – 2017-2020 |

|

Base Year – 2020 |

|

|

Forecast – 2021 – 2027 |

|

|

Facts Covered |

Revenue in USD Billion |

|

Market Coverage |

U.S, Canada, Germany, UK, France, Italy, Spain, Brazil, Mexico, Japan, South Korea, China, India, UAE, South Africa, Saudi Arabia |

|

Product Service/Segmentation |

By Product Type, By Distribution Channel, By Region |

|

Key Players |

Hengan International Group Co. Ltd, Kimberly Clark Corporation, Procter & Gamble Company, Unicharm Corporation, Johnson & Johnson, Kao Corporation, Ontex Group, Hayat Kimya Sanayi AS, Seventh Generation, Domtar Corporation, Drylock Technologies, Cotton Babies Inc., Winc Design Limited, Daio Paper Corporation, Essity Aktiebolag, Bumkins, First Quality Enterprises, Inc., The Honest Company, Inc., The Hain Celestial Group, Inc., and other prominent players. |

By Product Type

-

Cloth Diapers

-

Disposable Diapers

-

Training Nappies

-

Swim Pants

-

Biodegradable Diapers

By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Retail Stores

-

Specialty Store

-

Online Channel

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

- Research Framework

- Research Objective

- Product Overview

- Key Market Segments

- Research Methodology

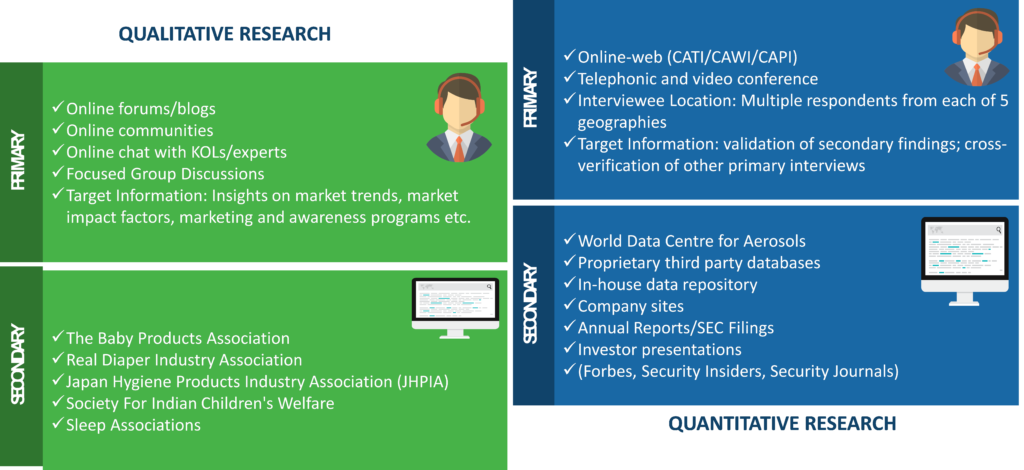

- Qualitative Research

- Methodology

- Regional Split of Primary & Secondary Research

- Secondary Research

- Primary Research

- Breakdown of Primary Research Respondents, By Region

- Breakdown of Primary Research Respondents, By Industry Participants

- Market Size Estimation

- Assumptions for the Study

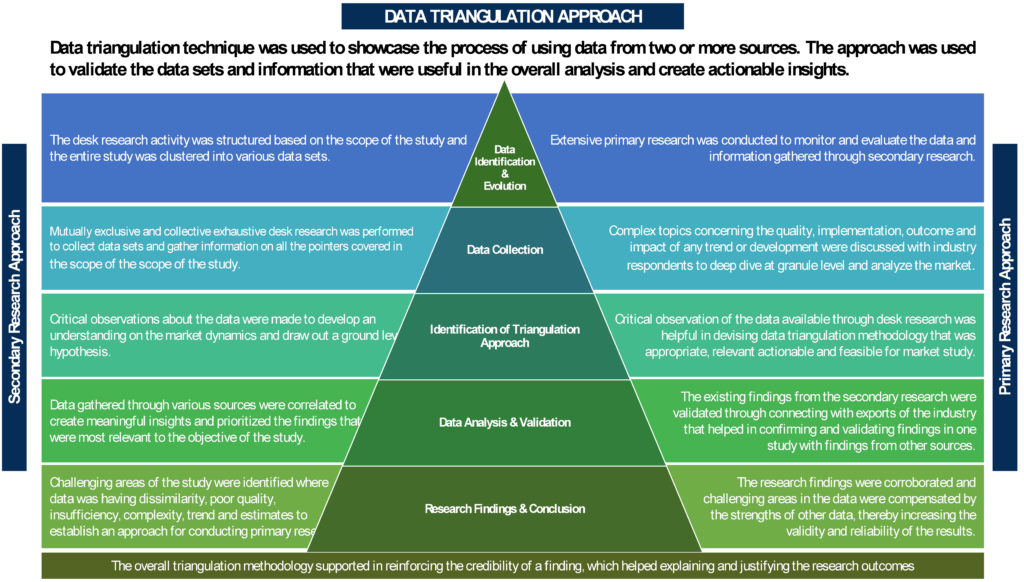

- Market Breakdown & Data Triangulation

- Executive Summary

- Industry Insight and Growth Strategy

- Value Chain Analysis

- DROC Analysis

- Market Drivers

- Increasing Number of Babies Born

- Growing Penetration of Online Channels

- Market Restraints

- Side Effects of Using Diapers Regularly

- Market Challenges

- Negative Impact of the COVID-19 Pandemic

- Market Opportunity

- Growing Health Awareness Regarding Babies and Infants

- Increasing Demand for Biodegradable Baby Diapers

- Market Drivers

- Recent Developments

- Porter’s Five Forces Analysis

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Intensity of Rivalry

- Threat of New Entrants

- Threat of Substitutes

- Baby Diapers Market Overview

- Market Size & Forecast by Value, 2017-2027

- Market Size and Forecast, By Segment

- By Product Type

- Cloth Diapers

- Disposable Diapers

- Training Nappies

- Swim Pants

- Biodegradable Diaperss

- By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Retail Stores

- Specialty Store

- Online Channel

- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- By Product Type

- North America Baby Diapers Market Overview

- Market Size and Forecast

- By Value (USD Billion), 2020-2027

- Market Share and Forecast

- By Component

- By Application

- By Country

- U.S.

- Canada

- Market Size and Forecast

- Europe Baby Diapers Market Overview

- Market Size and Forecast

- By Value (USD Billion), 2020-2027

- Market Share and Forecast

- By Component

- By Application

- By Country

- Germany

- U.K.

- Russia

- France

- Italy

- Spain

- Rest of Europe

- Market Size and Forecast

- APAC Baby Diapers Market Overview

- Market Size and Forecast

- By Value (USD Billion), 2020-2027

- Market Share and Forecast

- By Component

- By Application

- By Country

- China

- India

- Japan

- South Korea

- Rest of APAC

- Market Size and Forecast

- LATAM Baby Diapers Market Overview

- Market Size and Forecast

- By Value (USD Billion), 2020-2027

- Market Share and Forecast

- By Component

- By Application

- By Country

- Mexico

- Brazil

- Rest of LATAM

- Market Size and Forecast

- MEA Baby Diapers Market Overview

- Market Size and Forecast

- By Value (USD Billion), 2020-2027

- Market Share and Forecast

- By Component

- By Application

- By Country

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

- Market Size and Forecast

- Competitive Landscape

- List of Key Players and Their Offerings

- Market Share Analysis (2020)

- Competitive Benchmarking By Operating Parameters

- Impact of COVID-19 on Baby Diapers Market

- Company Profiles (Company Overview, Financial Matrix, Key Product landscape, Key Personnel, Key Competitors, Contact Address, and Strategic Outlook) *

- Hengan International Group Co. Ltd

- Kimberly Clark Corporation

- Procter & Gamble Company

- Unicharm Corporation

- Johnson & Johnson

- Kao Corporation

- Ontex Group

- Hayat Kimya Sanayi AS

- Seventh Generation

- Domtar Corporation

- Drylock Technologies

- Cotton Babies Inc.

- Winc Design Limited

- Daio Paper Corporation

- Essity Aktiebolag

- Bumkins

- First Quality Enterprises, Inc.

- The Honest Company, Inc.

- The Hain Celestial Group, Inc.

- Other Prominent Players

- Key Strategic Recommendations

List of Figures

Figure 1: Baby Diapers Market Segmentation

Figure 2: Baby Diapers Market Value Chain Analysis,

Figure 3: Company Market Share Analysis, 2020

Figure 4: Baby Diapers Market Size, By Value (USD Billion), 2017-2027

Figure 5: Baby Diapers Market Share (%), By Component, By Value, 2017-2027

Figure 6: Baby Diapers Market Share (%), By Application, By Value, 2017-2027

Figure 7: Baby Diapers Market Share (%), By Region, By Value, 2017-2027

Figure 8: North America Baby Diapers Market Size, By Value (USD Billion), 2017-2027

Figure 9: North America Baby Diapers Market Share (%), By Component, By Value, 2017-2027

Figure 10: North America Baby Diapers Market Share (%), By Application, By Value, 2017-2027

Figure 11: North America Baby Diapers Market Share (%), By Country, By Value, 2017-2027

Figure 12: Europe Baby Diapers Market Size, By Value (USD Billion), 2017-2027

Figure 13: Europe Baby Diapers Market Share (%), By Component, By Value, 2017-2027

Figure 14: Europe Baby Diapers Market Share (%), By Application, By Value, 2017-2027

Figure 15: Europe Baby Diapers Market Share (%), By Country, By Value, 2017-2027

Figure 16: the Asia-Pacific Baby Diapers Market Size, By Value (USD Billion), 2017-2027

Figure 17: the Asia-Pacific Baby Diapers Market Share (%), By Component, By Value, 2017-2027

Figure 18: the Asia-Pacific Baby Diapers Market Share (%), By Application, By Value, 2017-2027

Figure 19: Asia-Pacific Baby Diapers Market Share (%), By Country, By Value, 2017-2027

Figure 20: Latin America Baby Diapers Market Size, By Value (USD Billion), 2017-2027

Figure 21: Latin America Baby Diapers Market Share (%), By Component, By Value, 2017-2027

Figure 22: Latin America Baby Diapers Market Share (%), By Application, By Value, 2017-2027

Figure 23: Latin America Baby Diapers Market Share (%), By Country, By Value, 2017-2027

Figure 24: Middle East & Africa Baby Diapers Market Size, By Value (USD Billion), 2017-2027

Figure 25: Middle East & Africa Baby Diapers Market Share (%), By Component, By Value, 2017-2027

Figure 26: Middle East & Africa Baby Diapers Market Share (%), By Application, By Value, 2017-2027

Figure 27: Middle East & Africa Baby Diapers Market Share (%), By Region, By Value, 2017-2027

List of Tables

Table 1: Baby Diapers Market Size, By Component, By Value, 2017-2027

Table 2: Baby Diapers Market Size, By Application, By Value (USD Billion), 2017-2027

Table 3: Baby Diapers Market Size, By Region, By Value (USD Billion), 2017-2027

Table 4: North America Baby Diapers Market Size, By Component, By Value (USD Billion), 2017-2027

Table 5: North America Baby Diapers Market Size, By Application, By Value (USD Billion), 2017-2027

Table 6: North America Baby Diapers Market Size, By Country, By Value (USD Billion), 2017-2027

Table 7: Europe Baby Diapers Market Size, By Component, By Value (USD Billion), 2017-2027

Table 8: Europe Baby Diapers Market Size, By Application, By Value (USD Billion), 2017-2027

Table 9: Europe Baby Diapers Market Size, By Country, By Value (USD Billion), 2017-2027

Table 10: the Asia-Pacific Baby Diapers Market Size, By Component, By Value (USD Billion), 2017-2027

Table 11: the Asia-Pacific Baby Diapers Market Size, By Application, By Value (USD Billion), 2017-2027

Table 12: the Asia-Pacific Baby Diapers Market Size, By Country, By Value (USD Billion), 2017-2027

Table 13: Latin America Baby Diapers Market Size, By Component, By Value (USD Billion), 2017-2027

Table 14: Latin America Baby Diapers Market Size, By Application, By Value (USD Billion), 2017-2027

Table 15: Latin America Baby Diapers Market Size, By Country, By Value (USD Billion), 2017-2027

Table 16: The Middle-East & Africa Baby Diapers Market Size, By Component, By Value (USD Billion), 2017-2027

Table 17: The Middle-East & Africa Baby Diapers Market Size, By Application, By Value (USD Billion), 2017-2027

Table 18: The Middle-East & Africa Baby Diapers Market Size, By Country, By Value (USD Billion), 2017-2027

Table 19: Hengan International Group Co. Ltd Financial Analysis

Table 20: Hengan International Group Co. Ltd Business Overview

Table 21: Kimberly Clark Corporation Financial Analysis

Table 22: Kimberly Clark Corporation Business Overview

Table 23: Procter & Gamble Company Corporation Financial Analysis

Table 24: Procter & Gamble Company Corporation Business Overview

Table 25: Unicharm Corporation Financial Analysis

Table 26: Unicharm Corporation Business Overview

Table 27: Johnson & Johnson Financial Analysis

Table 28: Johnson & Johnson Business Overview

Table 29: Kao Corporation Financial Analysis

Table 30: Kao Corporation Business Overview

Table 31: Ontex Group Financial Analysis

Table 32: Ontex Group Business Overview

Table 33: Hayat Kimya Sanayi AS Financial Analysis

Table 34: Hayat Kimya Sanayi AS Business Overview

Table 35: Seventh Generation Financial Analysis

Table 36: Seventh Generation Business Overview

Table 37: Domtar Corporation Financial Analysis

Table 38: Domtar Corporation Business Overview

Table 39: Drylock Technologies Financial Analysis

Table 40: Drylock Technologies Financial Analysis

Table 41: Cotton Babies Inc. Financial Analysis

Table 42: Cotton Babies Inc. Financial Analysis

Table 43: Winc Design Limited Financial Analysis

Table 44: Winc Design Limited Financial Analysis

Table 45: Daio Paper Corporation Financial Analysis

Table 46: Daio Paper Corporation Financial Analysis

Table 47: Essity Aktiebolag Financial Analysis

Table 48: Essity Aktiebolag Financial Analysis

Table 49: Bumkins Financial Analysis

Table 50: Bumkins Financial Analysis

Table 51: First Quality Enterprises, Inc. Financial Analysis

Table 52: First Quality Enterprises, Inc. Financial Analysis

Table 53: The Honest Company, Inc. Financial Analysis

Table 54: The Honest Company, Inc. Financial Analysis

Table 55: The Hain Celestial Group, Inc. Financial Analysis

Table 56: The Hain Celestial Group, Inc. Financial Analysis

Market Segmentation

By Product Type

- Cloth Diapers

- Disposable Diapers

- Training Nappies

- Swim Pants

- Biodegradable Diapers

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Retail Stores

- Specialty Store

- Online Channel

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

1. Research Methodology

2. Regional Split of Primary & Secondary Research

3. Secondary Research

The research process began with obtaining historical market sizes of the entire baby diapers market and the share of each type of segmentation, through exhaustive secondary research to understand the potential of the market under the prevailing market environment during the past years. The growth rate of the market and its segments was studied with a comparative approach to understand the impact of factors that shaped the market during the recent past.

The next step involved the study of present market environment that is influencing the baby diapers market and its expected long-term impact. Weightage was given to several forces that are expected to affect the baby diapers, during the forecast period. Based on the interim analysis, the market numbers were formulated for each of the forecast years for every segment.

4. Primary Research

Various industry experts including CEOs, presidents, vice presidents, directors, sales managers, products managers, organization executives and other key people of the global baby diapers market were interviewed. The third step involved validation of hypothesis through segmented primary research with the key opinion leaders in the industry, including the company representatives, experts from distributer agencies, service providers and other industry experts. The primary research helped in assessing the gathered and assumed data with the real-time experience of industry representatives. This also led to modification in certain assumptions that were taken during the process of preliminary research. The analysts arrived at solid data points after the completion of primary research process.

In the fourth step, the market engineering was conducted, where the data points collected through secondary and primary sources were compiled to compute the final market sizes.

4.1 Breakdown of Primary Research Respondents, By Region

4.2 Breakdown of Primary Research Respondents, By Industry Participants

5. Market Size Estimation

Top-down approach has been followed to obtain the market size by region, and by country. Bottom-Up approach has been followed to obtain market size by form and by application.

An amalgamation of bottom-up and top-down approach has been performed to determine the revenue.

6. Assumptions for the Study

- The macro-economic factors would remain same during the forecast period.

- The market players would exhibit consistent performance during the forecast period without having any adverse ripple effects on the industry.

7. Market Breakdown & Data Triangulation

To request a free sample copy of this report, please complete the form below.

We value your investment and offer free customization with every report to fulfil your exact research needs.

Frequently Asked Questions (FAQs):

RELATED REPORTS

WHY CHOOSE US

-

24/7 Research Support

Get your queries resolved from an industry expert. Request for a free product review before report purchase.

-

Custom Research Service

Ask the Analyst to customize an exclusive study to serve your research needs

-

Quality & Accuracy

Ask the Analyst to customize an exclusive study to serve your research needs

-

Data Visualization

As the business world is changing dynamically every day. We need to stay pin point in relation to data management and optimum data utilization

-

Information security

We never share your personal and confidential information. Your personal information is safe and secure with us.