Global Air Purifier Market

Global Air Purifier Market- Industry Size, Share, Trend Analysis, Outlook, Growth, Opportunity and Forecast, 2017-2027, Segmented By Technology (HEPA Technology (High-Efficiency Particulate Air), Activated Carbon Technology, UV Technology, Negative Ion, Others), By Coverage (<324 Sq. Ft., 324-538 Sq. Ft., 539-753 Sq. Ft., >753 sq. Ft.), By Product Type (Portable Air Purifiers, Whole-House Air Purifiers, and Cleaners, Electrostatic Precipitators, Smart air purifier, Others), By Distribution Channel (Online Distribution Channel, Offline Distribution Channel), By Application (Residential, Industrial, Commercial), By Region (North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), Middle-East & Africa (MEA)

- Published Date: January 2022

- Report ID: BWC1809

- Available Format: PDF

- Page: 188

Report Overview

The global air purifier market is gaining significant traction because of the degrading air quality levels which are leading to severe breathing problems for people along with rapid industrialization and urbanization along with the increasing prevalence of airborne diseases.

Global Air Purifier Market- Industry Trends & Forecast Report 2027

The global air purifier market was worth USD 10.7 billion in 2020 and is further projected to reach USD 21.6 billion by the year 2027, growing at a CAGR of 10.6% in the forecast period (2021-2027). The market is gaining significant traction because of degrading air quality levels which are leading to severe breathing problems for people. Furthermore, rapid industrialization and urbanization, along with the increasing prevalence of airborne diseases are anticipated to boost the global air purifier market during the forecast period.

Source: BlueWeave Consulting

Global Air Purifier Market- Overview

There are many particles in the air we breathe, including substances that could harm our health. An air purifier or air cleaner is a device that is used for removing harmful pollutants and contamination from air to make it breathable. In simpler terms, it improves indoor air quality. With deteriorating air quality, air purifiers have become a necessity. Air purifiers use a sophisticated filtration technology to capture airborne pollutants. The application of this technology offers a wide range of health benefits, such as relieving asthma symptoms, neutralizing unpleasant odors, eliminating hazardous asbestos particles, etc., and breathing in clean air can enhance one's life expectancy.

Global Air Purifier Market Forecast and Trends

Growth Drivers

Deteriorating Air Quality and Increasing Prevalence of Airborne Disease

A key factor driving the global air purifier market is the increasing level of air pollution caused by rapid industrialization and urbanization. The World Health Organization estimates that air pollution causes 2.4 million deaths every year. Moreover, air pollution causes the greatest number of deaths in low- and middle-income countries. As polluted air can cause serious health effects, such as lung cancer, asthma and COPD, and increased cardiac risk, the demand for efficient air purifiers in residential and commercial spaces in the forecast period is expected to drive the market growth.

Launch of Smart Air Purifiers

With high growth potential and increasing competitiveness, air purifier manufacturers are equipping advanced technologies such as artificial intelligence (AI), IoT, etc., into air purifiers to gain a competitive edge. In December 2021, Acer introduced smart air purifiers with sensors to monitor air quality and automatically adjust the speed of the air purifier. Likewise, SHARP-QNET Smart Air launched its next-gen air purifier in March 2021. This newly launched air purifier has incorporated IoT functionality which allows it to be connected to WiFi and have remote access through smartphones through the ‘SHARP Air’ mobile app. Such developments present lucrative growth opportunities to the global air purifiers market.

Restraints

High Cost of Air Purifiers

The high cost of air purifiers acts as a major restraining factor for the global air purifier market growth. Air purifiers, on average, cost around USD 185 and can go up to as much as USD 5000. The demand and supply also influence the price of air purifiers. Moreover, air purifiers in developing countries with high air pollution levels such as China or South Korea are expensive compared to Europe or North America. This may limit its adoption, especially among middle and low-income class groups.

Impact of COVID-19 on Global Air Purifier Market

Global Air Purifier Market - By Technology

Based on technology, the global air purifier market is categorized into HEPA technology (high-efficiency particulate air), activated carbon technology, UV technology, negative ion, and others. The HEPA technology holds the largest market share because of its capacity of filtering around 99.7 percent of the airborne particulate matter in indoor spaces. The activated carbon technology is anticipated to register significant growth during the forecast period because of its efficiency in eliminating odors, fumes, and gases pollutants for the indoor environment.

Global Air Purifier Market - By Coverage

Based on coverages, the global air purifier market is segmented into <324 Sq. Ft., 324-538 Sq. Ft., 539-753 Sq. Ft., and >753 Sq. Ft. Among these, the <324 sq. ft. segment accounts for the largest market share. This coverage is deemed suitable for rooms up to 300 sq. ft. That is why, this coverage of air purifiers is largely preferred by the residential segment, mainly among families living in flats and apartments. However, >753 sq. ft. segment also covers a substantial share in the market because of its prominent use in commercial facilities such as hospitals.

Global Air Purifier Market -

Geographically, the global air purifier market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle-East & Africa. North America accounts for the largest market share due to the high disposable income of consumers and increasing awareness of air pollution and its side effects on human health. Furthermore, a high concentration of leading air purifier manufacturers, including Honeywell International, Filtrete, Austin Air Systems, etc., are making the products more accessible, contributing to North America's overall air purifier market growth.

Global Air Purifier Market - Competitive Landscape

The leading market players of the global air purifier market are Honeywell International Inc., Whirlpool Corporation, LG Corporation, Sharp Corporation, Samsung Electronics Co., Ltd, Panasonic Corporation, Daikin Industries, Ltd, Camfil Group, Philips Electronics N.V., 3M Company, Mann+Hummel, Fumex Inc., Electrocorp, Eureka Forbes, SPX Flow, Blueair AB, IQAir, Coway Co., Ltd, Xiaomi Inc., and other prominent players.

The market is dominated by technological giants such as Xiaomi Inc., Coway Co., LG Corporation, etc. The companies launch a wide range of products at competitive prices to cater to the needs of various industries and consumers. They are also engaging in r&d activities to embed new technologies such as WiFi and AI into their products. Furthermore, the adoption of competitive strategies like partnerships, mergers, acquisitions, joint ventures, etc., is also prominent in this market.

Recent Developments

-

In November 2021, Bemis, a US-based toilet seat manufacturer, launched their first indoor air purifiers, which is a collection of three models, namely, the Tower, The Pedestal, The Pod.

-

In November 2021, The Pyure Company, a US-based air purification company, announced the launch of a new line of advanced portable air purification products, specially designed for the janitorial and sanitation industry.

Scope of the Report:

|

Attributes |

Details |

|

Years Considered |

Historical data – 2017-2020 |

|

Base Year – 2020 |

|

|

Forecast – 2021 – 2027 |

|

|

Facts Covered |

Revenue in USD Billion |

|

Market Coverage |

U.S, Canada, Germany, UK, France, Italy, Spain, Brazil, Mexico, Japan, South Korea, China, India, UAE, South Africa, Saudi Arabia |

|

Product Service/Segmentation |

By Technology, By Coverage, By Product Type, By Distribution Channel, By Application, By Region |

|

Key Players |

Honeywell International Inc., Whirlpool Corporation, LG Corporation, Sharp Corporation, Samsung Electronics Co., Ltd, Panasonic Corporation, Daikin Industries, Ltd, Camfil Group, Philips Electronics N.V., 3M Company, Mann+Hummel, Fumex Inc., Electrocorp, Eureka Forbes, SPX Flow, Blueair AB, IQAir, Coway Co., Ltd, Xiaomi Inc., and other prominent players. |

By Technology

-

HEPA Technology (High Efficiency Particulate Air)

-

Activated Carbon Technology

-

UV Technology

-

Negative Ion

-

Others

By Coverage

-

<324 Sq. Ft.

-

324-538 Sq. Ft.

-

539-753 Sq. Ft.

-

>753 Sq. Ft.

By Product Type

-

Portable Air Purifiers

-

Whole-House Air Purifiers and Cleaners

-

Electrostatic Precipitators

-

Smart air purifier

-

Others

By Distribution Channel

-

Online Distribution Channel

-

Offline Distribution Channel

-

Specialty stores

-

Departmental stores

-

Direct to Consumer

-

Others

By Application

-

Residential

-

Industrial

-

Commercial

By Region

-

North America

-

Europe

-

Asia-Pacific (APAC)

-

Latin America (LATAM)

-

Middle-East & Africa (MEA)

- Research Framework

- Research Objective

- Product Overview

- Market Segmentation

- Research Methodology

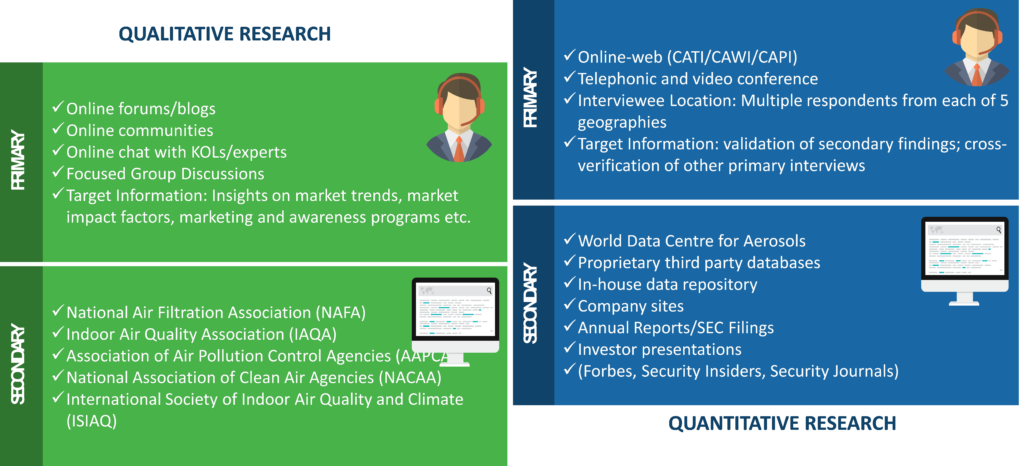

- Qualitative Research

- Methodology

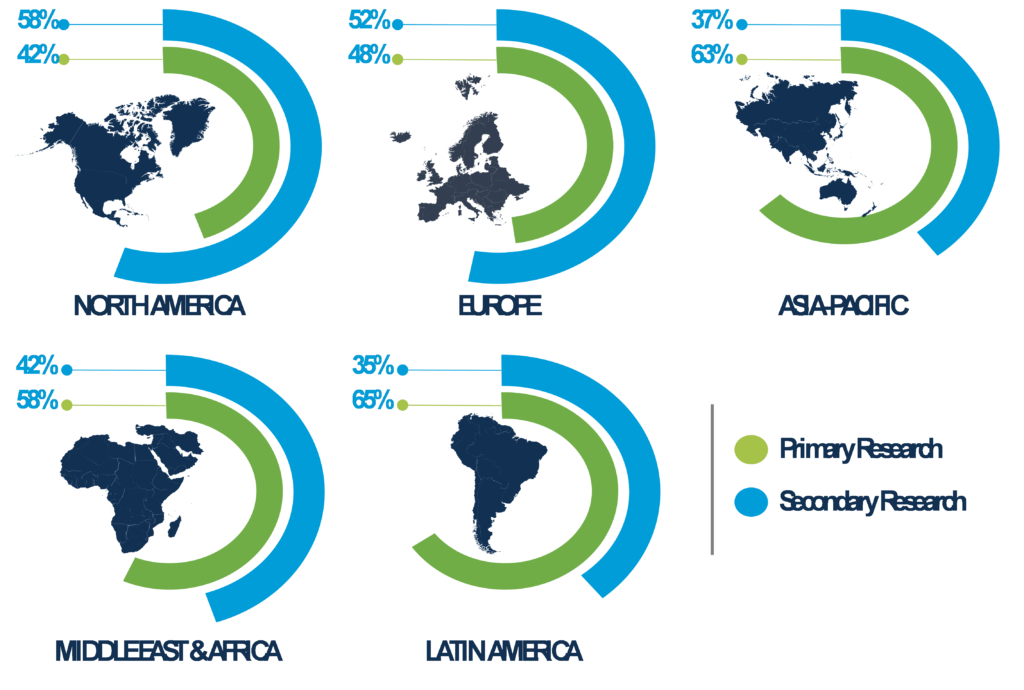

- Regional Split of Primary & Secondary Research

- Secondary Research

- Primary Research

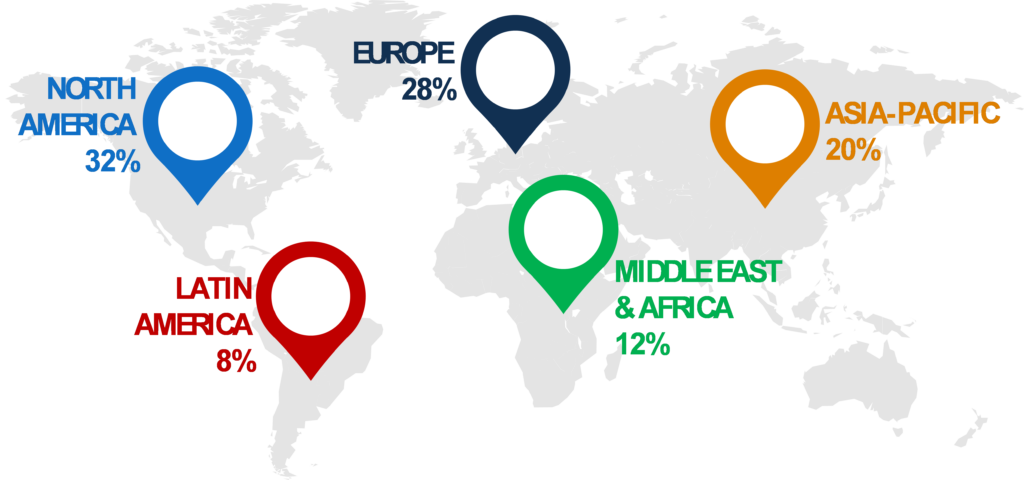

- Breakdown of Primary Research Respondents, By Region

- Breakdown of Primary Research Respondents, By Industry Participants

- Market Size Estimation

- Assumptions for the Study

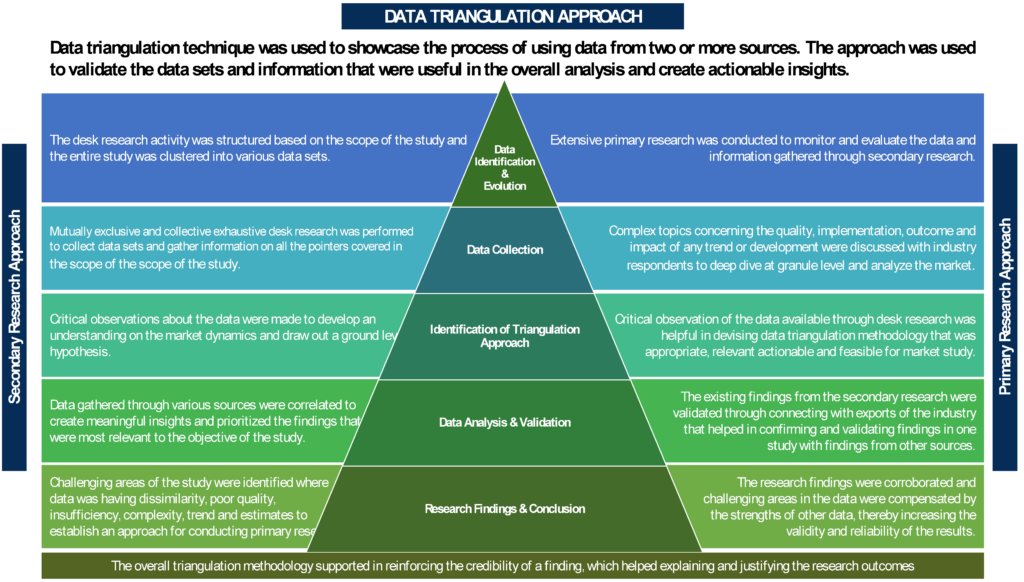

- Market Breakdown & Data Triangulation

- Executive Summary

- Industry Insight and Growth Strategy

- Value Chain Analysis

- DROC Analysis

- Growth Drivers

- Deteriorating Air Quality and Increasing Prevalence of Airborne Disease

- Launch of Smart Air Purifiers

- Restraints

- High Cost of Air Purifiers

- Opportunities

- Negative Impact of the COVID-19 Pandemic

- Challenges

- Increasing Penetration of Online Distribution Channels

- Growing Application of Air Purifiers in Commercial Facilities

- Growth Drivers

- Recent Developments

- Porter’s Five Forces Analysis

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Intensity of Rivalry

- Threat of New Entrants

- Threat of Substitutes

- Global Air Purifier Market Overview

- Market Estimates & Forecast by Value, 2017-2027

- Market Share & Forecast, by Segment

- By Technology

- HEPA Technology (High Efficiency Particulate Air)

- Activated Carbon Technology

- UV Technology

- Negative Ion

- Others

- By Coverage

- <324 Sq. Ft.

- 324-538 Sq. Ft.

- 539-753 Sq. Ft.

- >753 Sq. Ft.

- By Product Type

- Portable Air Purifiers

- Whole-House Air Purifiers and Cleaners

- Electrostatic Precipitators

- Smart air purifier

- Others

- By Distribution Channel

- Online Distribution Channel

- Offline Distribution Channel

- Specialty stores

- Departmental stores

- Direct to Consumer

- Others

- By Application

- Residential

- Industrial

- Commercial

- By Region

- North America

- Europe

- Asia-Pacific (APAC)

- Latin America (LATAM)

- Middle-East & Africa (MEA)

- By Technology

- North America Air Purifier Market Overview

- Market Size and Forecast

- By Value (USD Billion), 2017-2027

- Market Share and Forecast

- By Technology

- By Coverage

- By Product Type

- By Distribution Channel

- By Application

- By Country

- U.S.

- Canada

- Market Size and Forecast

- Europe Air Purifier Market Overview

- Market Size and Forecast

- By Value (USD Billion), 2017-2027

- Market Share and Forecast

- By Technology

- By Coverage

- By Product Type

- By Distribution Channel

- By Application

- By Country

- Germany

- U.K.

- France

- Italy

- Spain

- Netherlands

- Rest of Europe

- Market Size and Forecast

- APAC Air Purifier Market Overview

- Market Size and Forecast

- By Value (USD Billion), 2017-2027

- Market Share and Forecast

- By Technology

- By Coverage

- By Product Type

- By Distribution Channel

- By Application

- By Country

- China

- India

- Japan

- South Korea

- Rest of APAC

- Market Size and Forecast

- LATAM Air Purifier Market Overview

- Market Size and Forecast

- By Value (USD Billion), 2017-2027

- Market Share and Forecast

- By Technology

- By Coverage

- By Product Type

- By Distribution Channel

- By Application

- By Country

- Mexico

- Brazil

- Rest of LATAM

- Market Size and Forecast

- MEA Air Purifier Market Overview

- Market Size and Forecast

- By Value (USD Billion), 2017-2027

- Market Share and Forecast

- By Technology

- By Coverage

- By Product Type

- By Distribution Channel

- By Application

- By Country

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

- Market Size and Forecast

- Competitive Landscape

- List of Key Players and Their Offerings

- Market Share / Ranking Analysis (2020)

- Competitive Benchmarking, By Operating Parameters

- Impact of COVID-19 on Global Air Purifier Market

- Company Profiles (Company Overview, Financial Matrix, Key Product landscape, Key Personnel, Key Competitors, Contact Address, and Strategic Outlook) *

- Honeywell International Inc.

- Whirlpool Corporation

- LG Corporation

- Sharp Corporation

- Samsung Electronics Co., Ltd

- Panasonic Corporation

- Daikin Industries, Ltd

- Camfil Group

- Philips Electronics N.V.

- 3M Company

- Mann+Hummel

- Fumex Inc.

- Electrocorp

- Eureka Forbes

- SPX Flow

- Blueair AB

- IQAir

- Coway Co., Ltd

- Xiaomi Inc.

- Other Prominent Players

- Key Strategic Recommendations

List of Figures

Figure 1: Global Air Purifier Market Segmentation

Figure 2 : Global Air Purifier Market Value Chain Analysis,

Figure 3: Company Market Share Analysis, 2020

Figure 4: Global Air Purifier Market Size, By Value (USD Billion), 2017-2027

Figure 5: Global Air Purifier Market Share (%), By Technology, By Value, 2017-2027

Figure 6: Global Air Purifier Market Share (%), By Coverage, By Value, 2017-2027

Figure 7: Global Air Purifier Market Share (%), By Product Type, By Value, 2017-2027

Figure 8: Global Air Purifier Market Share (%), By Distribution Channel, By Value, 2017-2027

Figure 9: Global Air Purifier Market Share (%), By Application, By Value, 2017-2027

Figure 10: Global Air Purifier Market Share (%), By Region, By Value, 2017-2027

Figure 11: North America Air Purifier Market Size, By Value (USD Billion), 2017-2027

Figure 12: North America Air Purifier Market Share (%), By Technology, By Value, 2017-2027

Figure 13: North America Air Purifier Market Share (%), By Coverage, By Value, 2017-2027

Figure 14: North America Air Purifier Market Share (%), By Product Type, By Value, 2017-2027

Figure 15: North America Air Purifier Market Share (%), By Distribution Channel, By Value, 2017-2027

Figure 16: North America Air Purifier Market Share (%), By Application, By Value, 2017-2027

Figure 17: North America Air Purifier Market Share (%), By Country, By Value, 2017-2027

Figure 18: Europe Air Purifier Market Size, By Value (USD Billion), 2017-2027

Figure 19: Europe Air Purifier Market Share (%), By Technology, By Value, 2017-2027

Figure 20: Europe Air Purifier Market Share (%), By Coverage, By Value, 2017-2027

Figure 21: Europe Air Purifier Market Share (%), By Product Type, By Value, 2017-2027

Figure 22: Europe Air Purifier Market Share (%), By Distribution Channel, By Value, 2017-2027

Figure 23: Europe Air Purifier Market Share (%), by Application, By Value, 2017-2027

Figure 24: Europe Air Purifier Market Share (%), By Country, By Value, 2017-2027

Figure 25: Asia-Pacific Air Purifier Market Size, By Value (USD Billion), 2017-2027

Figure 26: Asia-Pacific Air Purifier Market Share (%), By Technology, By Value, 2017-2027

Figure 27: Asia-Pacific Air Purifier Market Share (%), By Coverage, By Value, 2017-2027

Figure 28: Asia-Pacific Air Purifier Market Share (%), By Product Type, By Value, 2017-2027

Figure 29: Asia-Pacific Air Purifier Market Share (%), By Distribution Channel, By Value, 2017-2027

Figure 30: Asia-Pacific Air Purifier Market Share (%), By Application, By Value, 2017-2027

Figure 31: Asia-Pacific Air Purifier Market Share (%), By Country, By Value, 2017-2027

Figure 32: Latin America Air Purifier Market Size, By Value (USD Billion), 2017-2027

Figure 33: Latin America Air Purifier Market Share (%), By Technology, By Value, 2017-2027

Figure 34: Latin America Air Purifier Market Share (%), By Coverage, By Value, 2017-2027

Figure 35: Latin America Air Purifier Market Share (%), By Product Type, By Value, 2017-2027

Figure 36: Latin America Air Purifier Market Share (%), By Distribution Channel, By Value, 2017-2027

Figure 37: Latin America Air Purifier Market Share (%), By Application, By Value, 2017-2027

Figure 38: Latin America Air Purifier Market Share (%), By Country, By Value, 2017-2027

Figure 39: Middle East & Africa Air Purifier Market Size, By Value (USD Billion), 2017-2027

Figure 40: Middle East & Africa Air Purifier Market Share (%), By Technology, By Value, 2017-2027

Figure 41: Middle East & Africa Air Purifier Market Share (%), By Coverage, By Value, 2017-2027

Figure 42: Middle East & Africa Air Purifier Market Share (%), By Product Type, By Value, 2017-2027

Figure 43: Middle East & Africa Air Purifier Market Share (%), By Distribution Channel, By Value, 2017-2027

Figure 44: Middle East & Africa Air Purifier Market Share (%), By Application, By Value, 2017-2027

Figure 45: Middle East & Africa Air Purifier Market Share (%), By Region, By Value, 2017-2027

List of Tables

Table 1: Global Air Purifier Market Size, By Technology, By Value, 2017-2027

Table 2: Global Air Purifier Market Size, By Coverage, By Value (USD Billion), 2017-2027

Table 3: Global Air Purifier Market Size, By Product Type, By Value (USD Billion), 2017-2027

Table 4: Global Air Purifier Market Size, By Distribution Channel, By Value (USD Billion), 2017-2027

Table 5: Global Air Purifier Market Size, By Application, By Value (USD Billion), 2017-2027

Table 6: Global Air Purifier Market Size, By Region, By Value (USD Billion), 2017-2027

Table 7: North America Air Purifier Market Size, By Technology, By Value (USD Billion), 2017-2027

Table 8: North America Air Purifier Market Size, By Coverage, By Value (USD Billion), 2017-2027

Table 9: North America Air Purifier Market Size, By Product Type, By Value (USD Billion), 2017-2027

Table 10: North America Air Purifier Market Size, By Distribution Channel, By Value (USD Billion), 2017-2027

Table 11: North America Air Purifier Market Size, By Application, By Value (USD Billion), 2017-2027,

Table 12: Europe Air Purifier Market Size, By Technology, By Value (USD Billion), 2017-2027

Table 13: Europe Air Purifier Market Size, By Coverage, By Value (USD Billion), 2017-2027

Table 14: Europe Air Purifier Market Size, By Product Type, By Value (USD Billion), 2017-2027

Table 15: Europe Air Purifier Market Size, By Distribution Channel, By Value (USD Billion), 2017-2027

Table 16: Europe Air Purifier Market Size, By Application, By Value (USD Billion), 2017-2027

Table 17: the Asia-Pacific Air Purifier Market Size, By Technology, By Value (USD Billion), 2017-2027

Table 18: the Asia-Pacific Air Purifier Market Size, By Coverage, By Value (USD Billion), 2017-2027

Table 19: the Asia-Pacific Air Purifier Market Size, By Product Type, By Value (USD Billion), 2017-2027

Table 20: the Asia-Pacific Air Purifier Market Size, By Distribution Channel, By Value (USD Billion), 2017-2027

Table 21: the Asia-Pacific Air Purifier Market Size, By Application, By Value (USD Billion), 2017-2027

Table 22: Latin America Air Purifier Market Size, By Technology, By Value (USD Billion), 2017-2027

Table 23: Latin America Air Purifier Market Size, By Coverage, By Value (USD Billion), 2017-2027

Table 24: Latin America Air Purifier Market Size, By Product Type, By Value (USD Billion), 2017-2027

Table 25: Latin America Air Purifier Market Size, By Distribution Channel, By Value (USD Billion), 2017-2027

Table 26: Latin America Air Purifier Market Size, By Application, By Value (USD Billion), 2017-2027

Table 27: The Middle-East & Africa Air Purifier Market Size, By Technology, By Value (USD Billion), 2017-2027

Table 28: The Middle-East & Africa Air Purifier Market Size, By Coverage, By Value (USD Billion), 2017-2027

Table 29: The Middle-East & Africa Air Purifier Market Size, By Product Type, By Value (USD Billion), 2017-2027

Table 30: The Middle-East & Africa Air Purifier Market Size, By Distribution Channel, By Value (USD Billion), 2017-2027

Table 31: The Middle-East & Africa Air Purifier Market Size, By Application, By Value (USD Billion), 2017-2027

Table 32: Honeywell International Inc. Financial Analysis

Table 33: Honeywell International Inc. Business Overview

Table 34: Whirlpool Corporation Financial Analysis

Table 35: Whirlpool Corporation Business Overview

Table 36: LG Corporation Financial Analysis

Table 37: LG Corporation Business Overview

Table 38: Sharp Corporation Financial Analysis

Table 39: Sharp Corporation Business Overview

Table 40: Samsung Electronics Co., Ltd Financial Analysis

Table 41: Samsung Electronics Co., Ltd Business Overview

Table 42: Panasonic Corporation Financial Analysis

Table 43: Panasonic Corporation Business Overview

Table 44: Daikin Industries, Ltd Financial Analysis

Table 45: Daikin Industries, Ltd. Business Overview

Table 46: Camfil Group Financial Analysis

Table 47: Camfil Group Business Overview

Table 48: Philips Electronics N.V. Financial Analysis

Table 49: Philips Electronics N.V. Business Overview

Table 50: 3M Company Financial Analysis

Table 51: 3M Company Business Overview

Table 52: Mann+Hummel Financial Analysis

Table 53: Mann+Hummel Financial Analysis

Table 54: Fumex Inc. Financial Analysis

Table 55: Fumex Inc. Financial Analysis

Table 56: Electrocorp Financial Analysis

Table 57: Electrocorp Financial Analysis

Table 58: Eureka Forbes Financial Analysis

Table 59: Eureka Forbes Financial Analysis

Table 60: SPX Flow Financial Analysis

Table 61: SPX Flow Financial Analysis

Table 62: Blueair AB Financial Analysis

Table 63: Blueair AB Financial Analysis

Table 64: IQAir Financial Analysis

Table 65: IQAir Financial Analysis

Table 66: Coway Co., Ltd Financial Analysis

Table 67: Coway Co., Ltd Financial Analysis

Table 68: Xiaomi Inc. Financial Analysis

Table 69: Xiaomi Inc. Financial Analysis

Market Segmentation

By Technology

- HEPA Technology (High Efficiency Particulate Air)

- Activated Carbon Technology

- UV Technology

- Negative Ion

- Others

By Coverage

- <324 Sq. Ft.

- 324-538 Sq. Ft.

- 539-753 Sq. Ft.

- >753 Sq. Ft.

By Product Type

- Portable Air Purifiers

- Whole-House Air Purifiers and Cleaners

- Electrostatic Precipitators

- Smart air purifier

- Others

By Distribution Channel

- Online Distribution Channel

- Offline Distribution Channel

- Specialty stores

- Departmental stores

- Direct to Consumer

- Others

By Application

- Residential

- Industrial

- Commercial

By Region

- North America

- Europe

- Asia-Pacific (APAC)

- Latin America (LATAM)

- Middle-East & Africa (MEA)

1. Research Methodology

2. Regional Split of Primary & Secondary Research

3. Secondary Research

The research process began with obtaining historical market sizes of the entire air purifier market and the share of each type of segmentation, through exhaustive secondary research to understand the potential of the market under the prevailing market environment during the past years. The growth rate of the market and its segments was studied with a comparative approach to understand the impact of factors that shaped the market during the recent past.

The next step involved the study of present market environment that is influencing the air purifier market and its expected long-term impact. Weightage was given to several forces that are expected to affect the home security market, during the forecast period. Based on the interim analysis, the market numbers were formulated for each of the forecast years for every segment.

4. Primary Research

Various industry experts including CEOs, presidents, vice presidents, directors, sales managers, products managers, organization executives and other key people of the global aerosol market were interviewed. The third step involved validation of hypothesis through segmented primary research with the key opinion leaders in the industry, including the company representatives, experts from distributer agencies, service providers and other industry experts. The primary research helped in assessing the gathered and assumed data with the real-time experience of industry representatives. This also led to modification in certain assumptions that were taken during the process of preliminary research. The analysts arrived at solid data points after the completion of primary research process.

In the fourth step, the market engineering was conducted, where the data points collected through secondary and primary sources were compiled to compute the final market sizes.

4.1 Breakdown of Primary Research Respondents, By Region

4.2 Breakdown of Primary Research Respondents, By Industry Participants

5. Market Size Estimation

Top-down approach has been followed to obtain the market size by region, and by country. Bottom-Up approach has been followed to obtain market size by technology, by distribution channel, by product and by end-user.

An amalgamation of bottom-up and top-down approach has been performed to determine the revenue.

6. Assumptions for the Study

- The macro-economic factors would remain same during the forecast period.

- The market players would exhibit consistent performance during the forecast period without having any adverse ripple effects on the industry.

7. Market Breakdown & Data Triangulation

To request a free sample copy of this report, please complete the form below.

We value your investment and offer free customization with every report to fulfil your exact research needs.

Frequently Asked Questions (FAQs):

RELATED REPORTS

WHY CHOOSE US

-

24/7 Research Support

Get your queries resolved from an industry expert. Request for a free product review before report purchase.

-

Custom Research Service

Ask the Analyst to customize an exclusive study to serve your research needs

-

Quality & Accuracy

Ask the Analyst to customize an exclusive study to serve your research needs

-

Data Visualization

As the business world is changing dynamically every day. We need to stay pin point in relation to data management and optimum data utilization

-

Information security

We never share your personal and confidential information. Your personal information is safe and secure with us.