Craft Beer Market

SPECIAL OFFER : 25% Super Discount For All !

Global Craft Beer Market, By Product Type (Lager, Ale, Stout & Porter and Others), By Distribution (On-Trade & Off-Trade), By Region (North America, Europe, Asia Pacific, Middle East & Africa and Latin America); Size and Forecast, 2014-2025

- Published Date: September 2018

- Report ID: BWC1823

- Available Format: PDF

- Page: 175

Report Overview

Global Craft Beer Market: Overview

The global craft beer market is estimated to grow at a CAGR of 22.76%, in value terms, during the forecast period 2018-2025. Craft Beers are produced in small breweries, using traditional methods and ingredients inspired by local taste, texture, and flavors. Moreover, it is produced in small quantity. The rising number of microbreweries across the globe produces a small amount of beer but emphasize on the quality, taste and new product innovation according to the changing palate of beer drinkers. Increasing government support for microbreweries via start-up will boost the production of craft beers in the coming years. Shifting consumer’s preferences towards a healthy lifestyle has influenced the younger population to adopt healthier beverages with low alcohol content like craft beer.

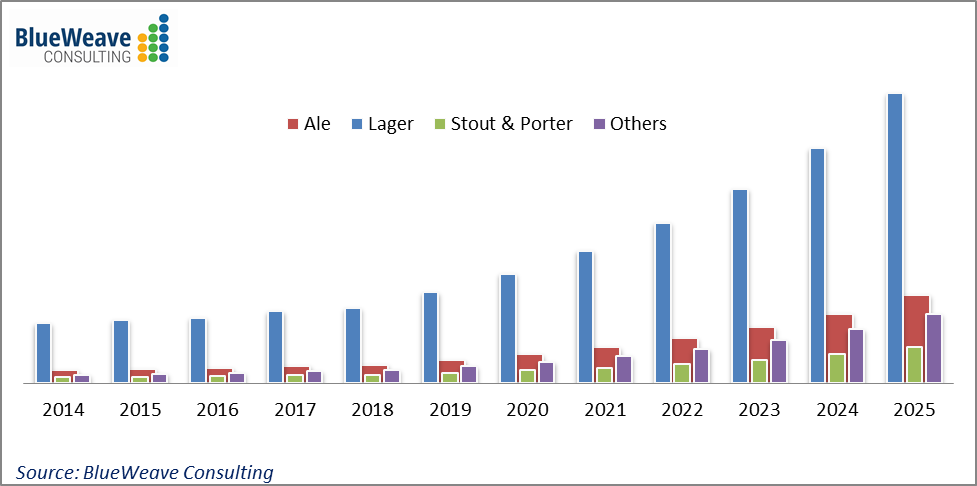

Global Craft Beer Market Size, By Product Type, 2014-2025 (USD Billion)

Lager is projected to be the leading segment of the overall Craft Beer Product Market during the forecast period.

On the basis of product type, the craft beer market has been segmented into Lager, Ale, Stout & Porter and Others. Lager segment dominates the global craft beer with 68.21% market share of the total craft beer market and projected to lead the market over the forecast period 2018-2025. Due to the increase in preference for lower but value based product consumption of alcohol. Moreover, the carbohydrates present in lager are beneficial for health along with other health benefits. Ale is projected to be the fastest growing craft beer market in terms of value with a CAGR over 25% for the forecast period, 2018-2025.

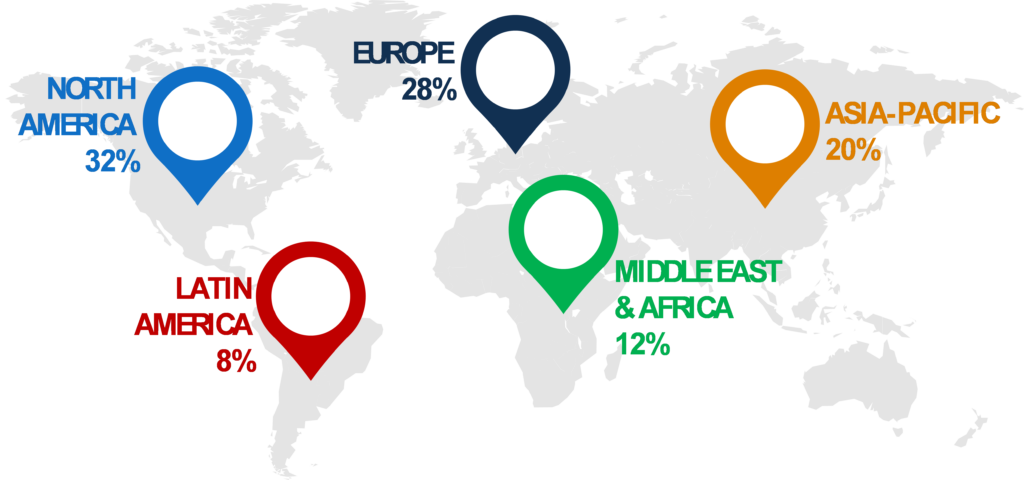

North America accounts for the largest share of the Global Craft Beer Market during the forecast period.

On the basis of region, the craft beer market has been segmental into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America dominates the world craft beer with 36.26% market share of the entire craft beer market and projected to lead the market over the forecast period, 2018-2025. Africa is projected to be the fastest growing market with a CAGR over 28% throughout the forecast period due to the increasing penetration in South Africa. The growing consumer awareness regarding the wide selection of flavors and styles of the product is expected to be a crucial factor for market growth in the country.

Objective of the Study:

·

To analyze and forecast market size of the world

craft brew market, in terms of useful & volume

·

To examine the careful market segmentation and

forecast the market size, in terms useful, on the premise of the region by

segmenting world craft brew market into 5 regions, namely, North America,

Europe, Asia Pacific, Middle East, and geographical area.

·

To outline, categorized and forecast the world

brew market on the premise of product kind and channel.

·

To examine competitive developments like

expansions, technological advancement, new flavor launches, services, and

regulative framework within the world Craft brew market.

·

To pinpoint the drivers and challenges for the

world craft brew market

·

To spot the profile of leading players, that

area unit concerned within the producing and provide off craft brew globally.

Global Craft Beer Market Competitive Landscape

Companies, such as D.G. Yuengling and Son, Gambrinus Company, Heineken N.V, Boston Beer Company, Sierra Nevada Brewing Co., and Belgium Brewing Company are the key players in manufacturing craft beer. In terms of product offerings, Boston Beer Company and D.G. Yuengling and Son are the major players in the market, providing various tastes and flavors of craft beer.

Strategic Outlook for major Industry Player

·

In March 2018, D.G. Yuengling and Son have added

a new beer to its craft beer product portfolio, known as Golden Pilsner, a

modern pilsner crafted with the perfect balance of malt and hop for crisp,

smooth refreshment.

·

In May 2017, Heineken N.V acquired the 100%

stake in Lagunitas, a craft beer maker (having entered a 50/50 partnership in

2015), allowing the company to accelerate the expansion of the brand to many

markets around the world

·

In Aug 2017, New Belgium Brewing has entered

into a licensing agreement with Mohegan Sun, to feature New Belgium brand in

Mohegan’s gaming area. The company Taproom within the gaming area, will feature

12 craft beer lines, including sour and seasonal releases, expanding its

presence in the east coast

Business Questions answered by the report

·

How will the market drivers, restraints and

opportunities affect the market dynamics?

·

What will be the market size in terms of value

and volume and market statistics with detailed classification

·

Which segment dominates the market or region and

one will be the fastest growing and why?

·

A comprehensive survey of the competitive

landscape and the market participant players

·

Analysis of strategy adopted by the key player

and their impact on other players.

1.

Research Framework

1.1.

Market Definition and Product overview

2.

Research methodology

3.

Executive summary

4.

Craft Beer Industry Insights

4.1.

Industry Segmentation

4.2.

Industry ecosystem analysis

4.2.1.

Vendor Matrix

4.3.

Regulatory framework

4.4.

Raw material analysis

4.5.

Technological Landscape

4.6.

Industry impact and forces

4.6.1.

Growth drivers

4.6.1.1.

Increasing consumer preference for low alcohol by volume(ABV) beer

4.6.1.2.

Rise in number of Microbreweries across the globe

4.6.1.3.

Demand for premium beer or value-based beer

4.6.1.4.

Product innovation in beer market

4.6.2.

Industry challenges

4.6.2.1.

Limited availability of craft beers beyond the microbreweries

4.7.

Company market share analysis,2017

4.8.

Growth potential analysis,2017

4.9.

Porter’s analysis

4.10.

PESTEL analysis

5.

Global Craft Beer Market Overview

5.1.

Market size & Forecast

5.1.1.

By Value (USD Billion)

5.1.2.

By Volume (Billion Liters)

5.2.

Market Share & Forecast

5.2.1.

By product type

5.2.2.

By Distribution Channel

5.2.3.

By Region

6.

Craft Beer Market, By Product Type

6.1.

Key Product Trends

6.2.

Lager

6.2.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million

6.2.2.

Market estimates & forecast, by region, 2014-2025, (Billion Liters)(USD Million)

6.3.

Ale

6.3.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

6.3.2.

Market estimates & forecast, by region, 2014-2025, (Billion Liters)(USD Million)

6.4.

Stout & Porter

6.4.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

6.4.2.

Market estimates & forecast, by region, 2014-2025, (Billion Liters)(USD Million)

6.5.

Others

6.5.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

6.5.2.

Market estimates & forecast, by region, 2014-2025, (Billion Liters)(USD Million)

7.

Craft Beer Market, By Distribution

7.1.

Key Distribution trends, 2017

7.2.

On- trade

7.2.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million

7.2.2.

Market estimates & forecast, by region, 2014-2025, (Billion Liters)(USD Million)

7.3.

Off-trade

7.3.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

7.3.2.

Market estimates & forecast, by region, 2014-2025, (Billion Liters)(USD Million)

8.

Craft Beer Market, By Region

8.1.

Key Regional trends, 2017

8.2.

North America

8.2.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.2.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.2.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.2.4.

Market estimates & forecast, by country, 2014-2025, (Billion Liters)(USD Million)

8.2.5.

U.S.

8.2.5.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.2.5.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.2.5.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.2.6.

Canada

8.2.6.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.2.6.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.2.6.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.3.

Europe

8.3.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.3.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.3.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.3.4.

Market estimates & forecast, by country, 2014-2025, (Billion Liters)(USD Million)

8.3.5.

Germany

8.3.5.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.3.5.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.3.5.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.3.6.

UK

8.3.6.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.3.6.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.3.6.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.3.7.

France

8.3.7.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.3.7.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.3.7.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.3.8.

Italy

8.3.8.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.3.8.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.3.8.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.4.

Asia Pacific

8.4.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.4.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.4.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.4.4.

Market estimates & forecast, by country, 2014-2025, (Billion Liters)(USD Million)

8.4.5.

China

8.4.5.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.4.5.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.4.5.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.4.6.

India

8.4.6.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.4.6.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.4.6.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.4.7.

Japan

8.4.7.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.4.7.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.4.7.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.4.8.

Australia

8.4.8.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.4.8.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.4.8.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.4.9.

South Korea

8.4.9.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.4.9.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.4.9.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.4.10.

Singapore

8.4.10.1. Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.4.10.2. Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.4.10.3. Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.5.

LATAM

8.5.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.5.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.5.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.5.4.

Market estimates & forecast, by country, 2014-2025, (Billion Liters)(USD Million)

8.5.5.

Brazil

8.5.5.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.5.5.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.5.5.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.5.6.

Mexico

8.5.6.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.5.6.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.5.6.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.5.7.

Argentina

8.5.7.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.5.7.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.5.7.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.6.

Middle East & Africa (MEA)

8.6.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.6.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.6.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.6.4.

Market estimates & forecast, by country, 2014-2025, (Billion Liters)(USD Million)

8.6.5.

UAE

8.6.5.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.6.5.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.6.5.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.6.6.

Egypt

8.6.6.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.6.6.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.6.6.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

8.6.7.

South Africa

8.6.7.1.

Market estimates & forecast, 2014-2025, (Billion Liters)(USD Million)

8.6.7.2.

Market estimates & forecast by product type, 2014-2025, (Billion Liters)(USD Million)

8.6.7.3.

Market estimates & forecast, by distribution, 2014-2025, (Billion Liters)(USD Million)

9.

Company Profiles

9.1.

D.G. Yuengling and Son

9.1.1.

Company Overview

9.1.2.

Financial Matrix

9.1.3.

Key Product landscape

9.1.4.

Key Personnel

9.1.5.

Key Competitors

9.1.6.

Contact Address

9.1.7.

SWOT Analysis

9.1.8.

Strategic Outlook

9.2.

The Gambrinus Company

9.2.1.

Company Overview

9.2.2.

Financial Matrix

9.2.3.

Key Product landscape

9.2.4.

Key Personnel

9.2.5.

Key Competitors

9.2.6.

Contact Address

9.2.7.

SWOT Analysis

9.3.

Heineken N.V

9.3.1.

Company Overview

9.3.2.

Financial Matrix

9.3.3.

Key Product landscape

9.3.4.

Key Personnel

9.3.5.

Key Competitors

9.3.6.

Contact Address

9.3.7.

SWOT Analysis

9.4.

The Boston Beer Company

9.4.1.

Company Overview

9.4.2.

Financial Matrix

9.4.3.

Key Product landscape

9.4.4.

Key Personnel

9.4.5.

Key Competitors

9.4.6.

Contact Address

9.4.7.

SWOT Analysis

9.5.

Sierra Nevada Brewing Co

9.5.1.

Company Overview

9.5.2.

Financial Matrix

9.5.3.

Key Product landscape

9.5.4.

Key Personnel

9.5.5.

Key Competitors

9.5.6.

Contact Address

9.5.7.

SWOT Analysis

9.6.

New Belgium Brewing Company

9.6.1.

Company Overview

9.6.2.

Financial Matrix

9.6.3.

Key Product landscape

9.6.4.

Key Personnel

9.6.5.

Key Competitors

9.6.6.

Contact Address

9.6.7.

SWOT Analysis

9.7.

Bell’s Brewery, Inc.

9.7.1.

Company Overview

9.7.2.

Financial Matrix

9.7.3.

Key Product landscape

9.7.4.

Key Personnel

9.7.5.

Key Competitors

9.7.6.

Contact Address

9.7.7.

SWOT Analysis

9.8.

Deschutes Brewery

9.8.1.

Company Overview

9.8.2.

Financial Matrix

9.8.3.

Key Product landscape

9.8.4.

Key Personnel

9.8.5.

Key Competitors

9.8.6.

Contact Address

9.8.7.

SWOT Analysis

9.9.

Minhas Brewery

9.9.1.

Company Overview

9.9.2.

Financial Matrix

9.9.3.

Key Product landscape

9.9.4.

Key Personnel

9.9.5.

Key Competitors

9.9.6.

Contact Address

9.9.7.

SWOT Analysis

9.10.

Stone Brewing

9.10.1.

Company Overview

9.10.2.

Financial Matrix

9.10.3.

Key Product landscape

9.10.4.

Key Personnel

9.10.5.

Key Competitors

9.10.6.

Contact Address

9.10.7.

SWOT Analysis

9.11.

Omer Vander Ghinste

9.11.1.

Company Overview

9.11.2.

Financial Matrix

9.11.3.

Key Product landscape

9.11.4.

Key Personnel

9.11.5.

Key Competitors

9.11.6.

Contact Address

9.11.7.

SWOT Analysis

9.12.

Feral Brewing Co.

9.12.1.

Company Overview

9.12.2.

Financial Matrix

9.12.3.

Key Product landscape

9.12.4.

Key Personnel

9.12.5.

Key Competitors

9.12.6.

Contact Address

9.12.7.

SWOT Analysis

9.13.

Stone & Wood Brewing Co.

9.13.1.

Company Overview

9.13.2.

Financial Matrix

9.13.3.

Key Product landscape

9.13.4.

Key Personnel

9.13.5.

Key Competitors

9.13.6.

Contact Address

9.13.7.

SWOT Analysis

9.14.

Asahi Group Holdings

9.14.1.

Company Overview

9.14.2.

Financial Matrix

9.14.3.

Key Product landscape

9.14.4.

Key Personnel

9.14.5.

Key Competitors

9.14.6.

Contact Address

9.14.7.

SWOT Analysis

9.15.

Anheuser-Busch InBev

9.15.1.

Company Overview

9.15.2.

Financial Matrix

9.15.3.

Key Product landscape

9.15.4.

Key Personnel

9.15.5.

Key Competitors

9.15.6.

Contact Address

9.15.7.

SWOT Analysis

Market Segmentation

- Research Methodology

2. Regional Split of Primary & Secondary Research

3. Secondary Research

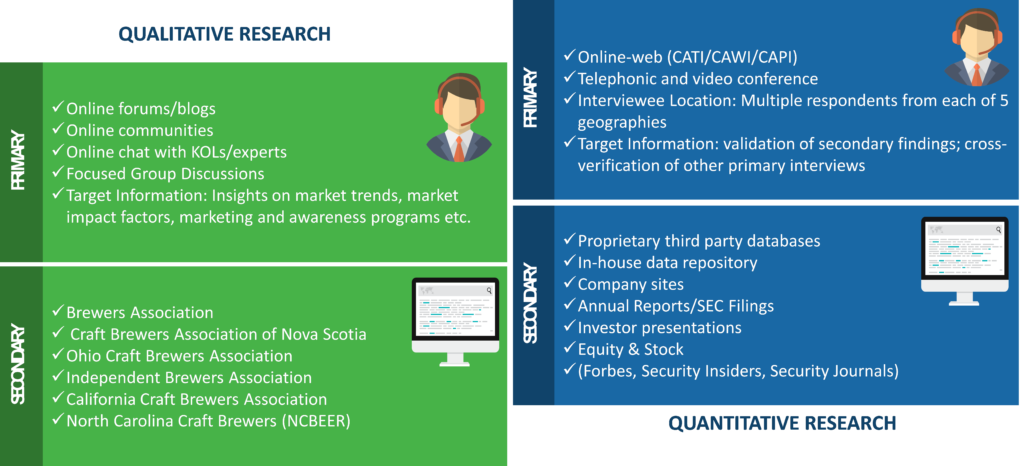

The research process began with obtaining historical market sizes of the entire craft beer market and the share of each type of segmentation, through exhaustive secondary research to understand the potential of the market under the prevailing market environment during the past years. The growth rate of the market and its segments was studied with a comparative approach to understand the impact of factors that shaped the market during the recent past.

The next step involved the study of present market environment that is influencing the craft beer market and its expected long-term impact. Weightage was given to several forces that are expected to affect the home security market, during the forecast period. Based on the interim analysis, the market numbers were formulated for each of the forecast years for every segment.

4. Primary Research

Various industry experts including CEOs, presidents, vice presidents, directors, sales managers, products managers, organization executives and other key people of the global craft beer market were interviewed. The third step involved validation of hypothesis through segmented primary research with the key opinion leaders in the industry, including the company representatives, experts from distributer agencies, service providers and other industry experts. The primary research helped in assessing the gathered and assumed data with the real-time experience of industry representatives. This also led to modification in certain assumptions that were taken during the process of preliminary research. The analysts arrived at solid data points after the completion of primary research process.

In the fourth step, the market engineering was conducted, where the data points collected through secondary and primary sources were compiled to compute the final market sizes.

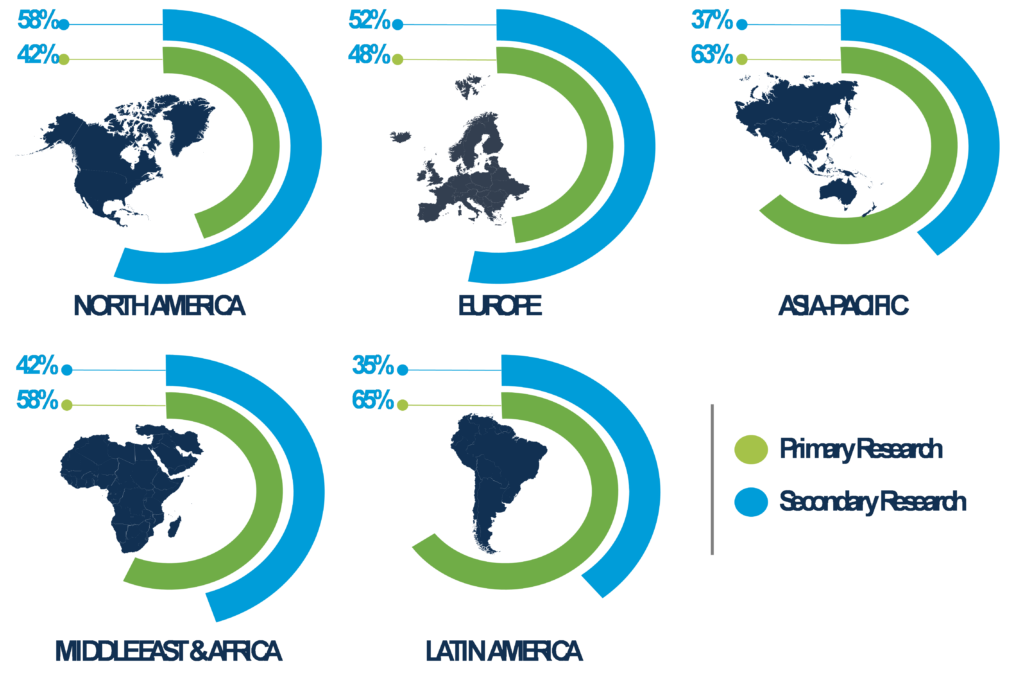

4.1 Breakdown of Primary Research Respondents, By Region

4.2 Breakdown of Primary Research Respondents, By Industry Participants

5. Market Size Estimation

Top-down approach has been followed to obtain the market size by region, and by country. Bottom-Up approach has been followed to obtain market size by product type and by distribution channel.

An amalgamation of bottom-up and top-down approach has been performed to determine the revenue.

6. Assumptions for the Study

- The macro-economic factors would remain same during the forecast period.

- The market players would exhibit consistent performance during the forecast period without having any adverse ripple effects on the industry.

To request a free sample copy of this report, please complete the form below.

We value your investment and offer free customization with every report to fulfil your exact research needs.

RELATED REPORTS

WHY CHOOSE US

-

24/7 Research Support

Get your queries resolved from an industry expert. Request for a free product review before report purchase.

-

Custom Research Service

Ask the Analyst to customize an exclusive study to serve your research needs

-

Quality & Accuracy

Ask the Analyst to customize an exclusive study to serve your research needs

-

Data Visualization

As the business world is changing dynamically every day. We need to stay pin point in relation to data management and optimum data utilization

-

Information security

We never share your personal and confidential information. Your personal information is safe and secure with us.